🔥spx, euro long and nifty short setups played out as discussed in the last webinar. 🔥gold long and nifty, btc short setups played out as discussed in the last webinar. 🔥euro, gold long setups and spx short setup played out as discussed in the last public […] In my progression as a … All discussions are based on advanced elliott wave, with detailed wave counts as well standard supply and demand analysis. And we will look for possible … Hello, this is your instructor, neerav yadav, founder of 50 eyes market analysis. Learn practical application of elliott wave for trading in live markets. In this trading opportunities webinar, neerav yadav (author of “think with the markets”) has discussed charts of forex, commodities, indices. I’m primarily a trader who started trading in crude oil futures. Interactive training for serious students. · in this trading opportunities webinar, neerav yadav (author of “think with the markets”) has discussed charts of forex, commodities, indices. 3314 to 13303 wave 2 : · in this session i will be doing elliott wave analysis of bank nifty ( an index of indian stock markets ) and will be giving future targets for the same. 🔥euro, gold long & oil short setups played out as discussed in the last public webinar. 🔥gold and spx long setups played out as discussed in the last public webinar. In the variation that i will discuss here wave 3 is still in progression. Detailed elliott wave analysis of crude oil, gold, s&p 500, nifty 50, stocks along with educational resources. 🔥euro short setup and spx long setup played out as discussed in the last public webinar. Who are you learning from? 13303 to 7766 (a little lower then the 50% retracement) wave 3 :

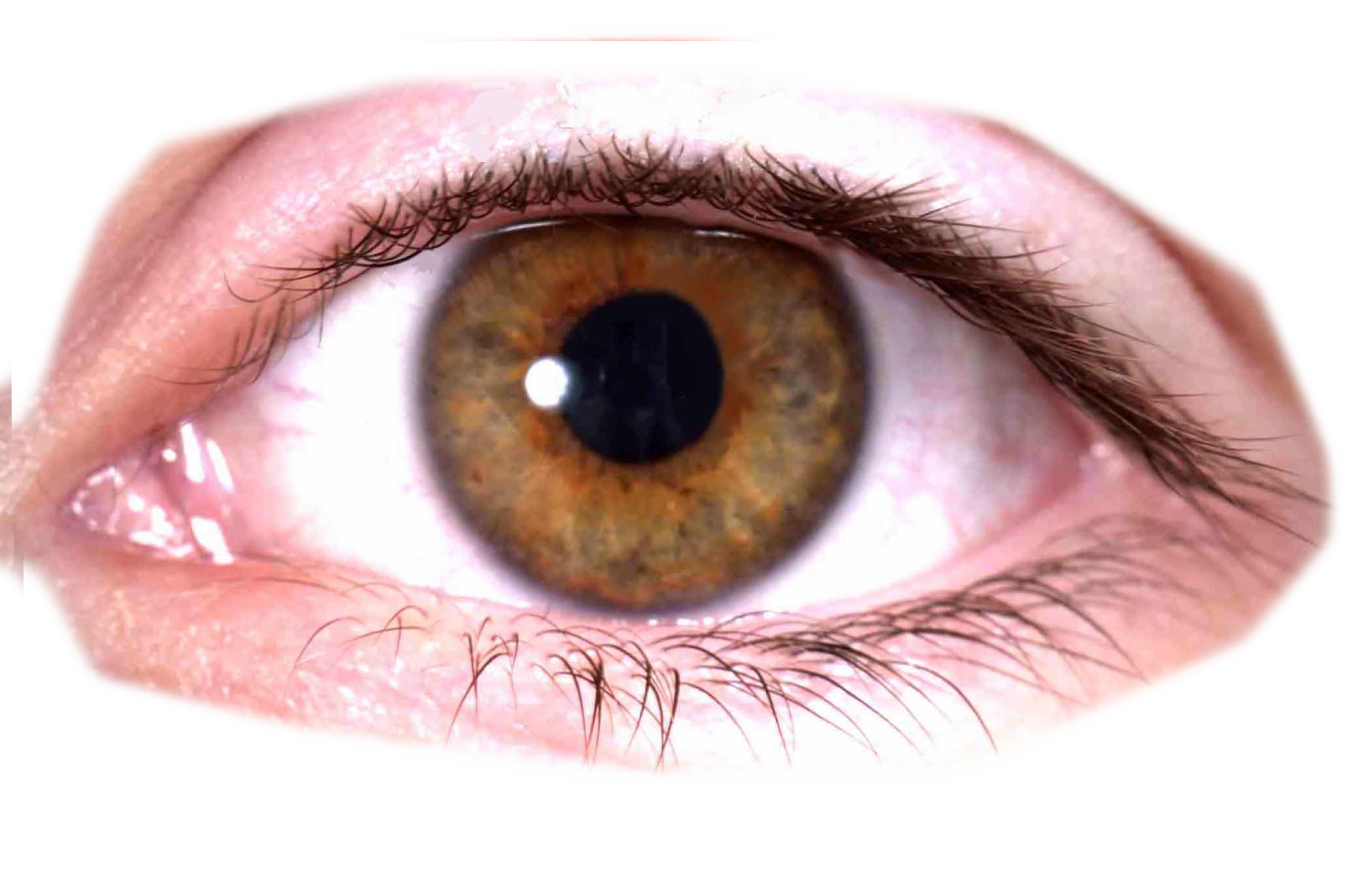

Eyes Of Wakanda August 1St A Four Episode Marathon You Wont Want To Miss

🔥spx, euro long and nifty short setups played out as discussed in the last webinar. 🔥gold long and nifty, btc short setups played out as...