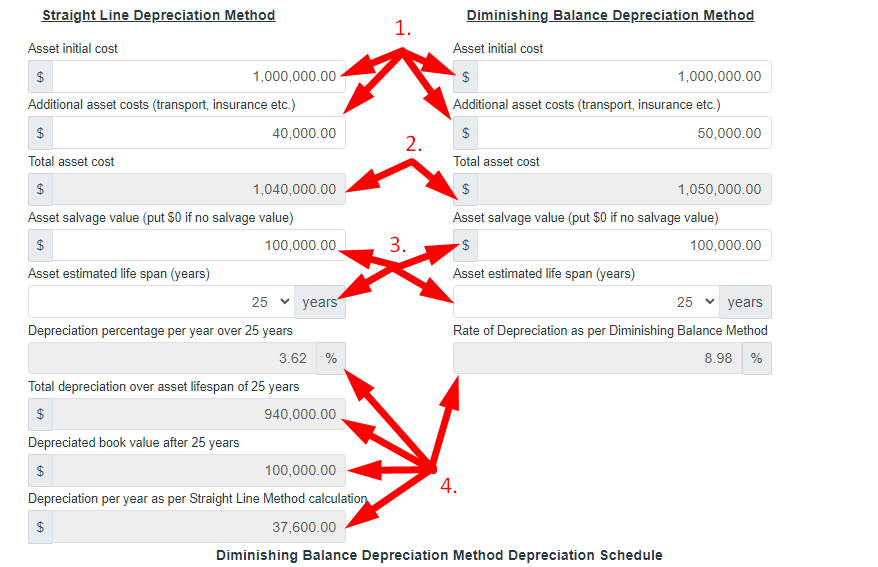

· learn what depreciation means, how to calculate it, and which method is suitable. Fast and accurate – just enter your details and get the result instantly. Get detailed depreciation schedules and book values. Use the right tools, keep your … Use our free online asset depreciation calculator to work out the depreciation of the fixed assets for your business. · one of the most common mistakes in depreciation accounting is choosing the wrong depreciation method. Calculate asset depreciation using different methods: Straight-line, declining balance, and sum-of-years digits. Calculate asset depreciation using different methods including straight-line, declining balance, sum-of-years, and macrs with our free online depreciation calculator. Essential for financial reporting, tax planning, and managing asset value over time. Determine the depreciation of your assets with the depreciation calculator. · avoiding common mistakes like ignoring depreciation, using incorrect rates, or poor record-keeping will save you stress and money in the long run. Depreciation is a way to reduce an asset’s value over a longer period of time. There are several methods to calculate depreciation: With this tool, you can find out the annual depreciation of an asset based on its initial cost, residual value, and useful life. Explore straight-line, reducing balance, hmrc rules, and xero integration. Easily determine the yearly depreciation expense, accumulated depreciation, and book values. Free depreciation calculator using the straight line, declining balance, or sum of the years digits methods with the option of partial year depreciation. Calculate and analyze depreciation schedules using our depreciation calculator.

Dont Make These Mistakes Check Your Depreciation With Our Calculator

· learn what depreciation means, how to calculate it, and which method is suitable. Fast and accurate – just enter your details and get the...