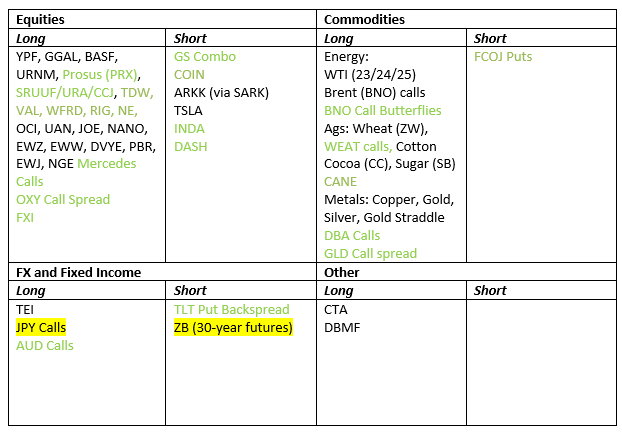

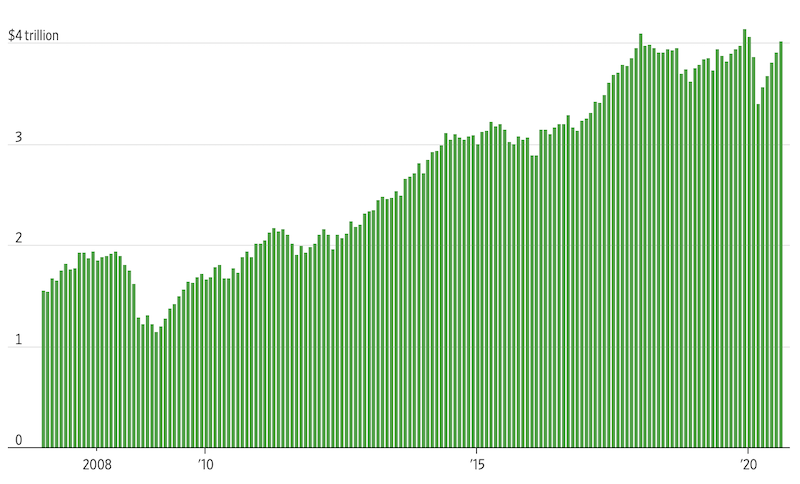

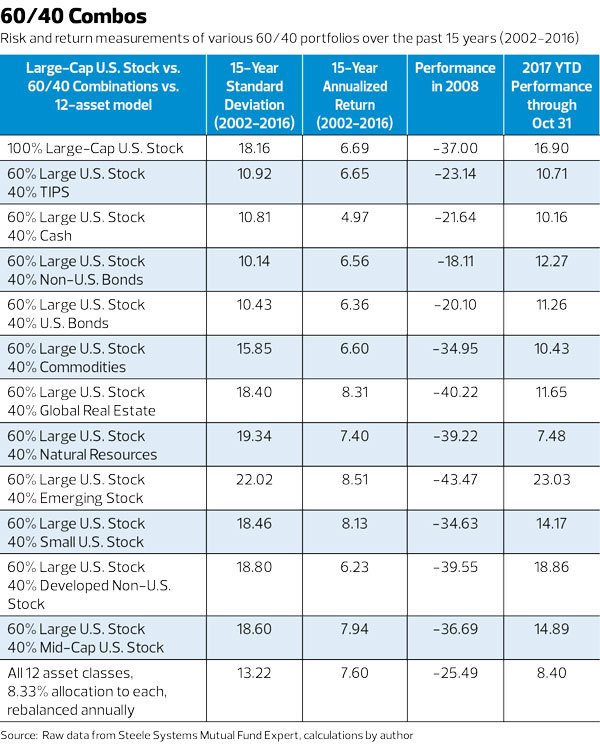

The 60/40 portfolio rose to prominence among investors due to its ease of implementation and attractive pattern of performance that has historically offered both participation during robust … · the traditional 60/40 portfolio—a mix of 60% stocks and 40% bonds—is suffering through one of its worst periods in history. Looking ahead, the macro outlook for 2024 seems to be predicated on rate cuts and falling inflation amid slowing growth. · so what does 2024 hold for the 60/40 portfolio? · a smarter, active stock-bond-macro-alt portfolio that incorporates these changes can offer meaningful advantages over passive 60/40, even during periods of shifting correlations. Even if changes in the macroeconomic landscape (unsustainable fiscal policy and less independent, less rules-based monetary policy are top-of-mind concerns) lead to persistently … · explore the shifting tides in investment landscapes and the evolving relevance of the traditional 60/40 portfolio. One researcher said that to improve the portfolios. · as such, broadening portfolio diversification beyond the traditional 60/40 framework was crucial for effectively navigating the shifting market environment. Uncover the challenges posed by changing market dynamics and discover alternative investment strategies for a diversified and resilient portfolio. Although the demise of the 60/40 portfolio has been … · the 60/40 portfolio has been the go-to diversified portfolio for investors, but it has been underperforming in the past couple of years. · to better understand the 60/40 investment portfolio and why it might be broken, we need to briefly mention the modern portfolio theory (mpt). · explore blackrock ceo larry finks take on why the 60/40 portfolio may not suffice for diversification anymore, proposing a 50/30/20 model with private assets.

Your Guide To Navigating The 6040 Portfolio Problem Fragmented Macro

The 60/40 portfolio rose to prominence among investors due to its ease of implementation and attractive pattern of performance that has historically offered both participation...